What is an Individual Retirement Account?

Individual retirement accounts (IRAs) are personal retirement savings accounts that offer tax benefits and a range of investment options. Many investors use IRAs as their common source of saving for retirement. Traditional IRAs, Roth IRAs, and Rollover IRAs are the three most commonly chosen individual retirement options. Variations of common IRA types include Inherited IRAs and Custodial IRAs. Each IRA has its own characteristics to evaluate when setting your retirement savings goals.

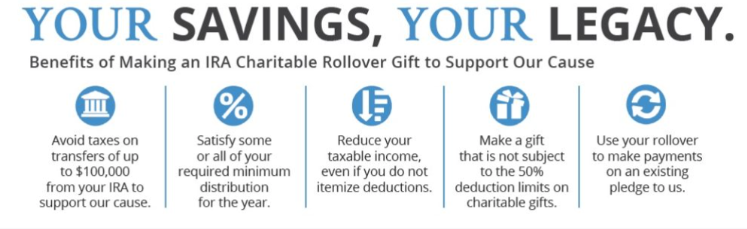

IRA owners age 70½ or over of their option to transfer up to $100,000 to charity tax-free each year.

These transfers, known as qualified charitable distributions or QCDs, offer eligible older Americans a great way to easily give to charity before the end of the year. Moreover, for those who are at least 72, QCDs count toward the IRA owner's required minimum distribution (RMD) for the year.

Any IRA owner who wishes to make a charitable contribution should contact their IRA trustee soon so the trustee will have time to complete the transaction before the end of the year.

Normally, distributions from a traditional individual retirement arrangement (IRA) are taxable when received. With a QCD, however, these distributions become tax-free as long as they're paid directly from the IRA to an eligible charitable organization.

QCDs can be made electronically, directly to the charity, or by check payable to the charity.